Transforming portfolio management into a strategic engine for growth

In today’s enterprise environment, portfolio management has evolved from a tactical function into a critical enabler of strategic outcomes. No longer can initiatives succeed in isolation—they must drive measurable impact, aligning closely with overarching business objectives. For transformation leaders, the complexity lies in maintaining this alignment across an ever-changing portfolio.

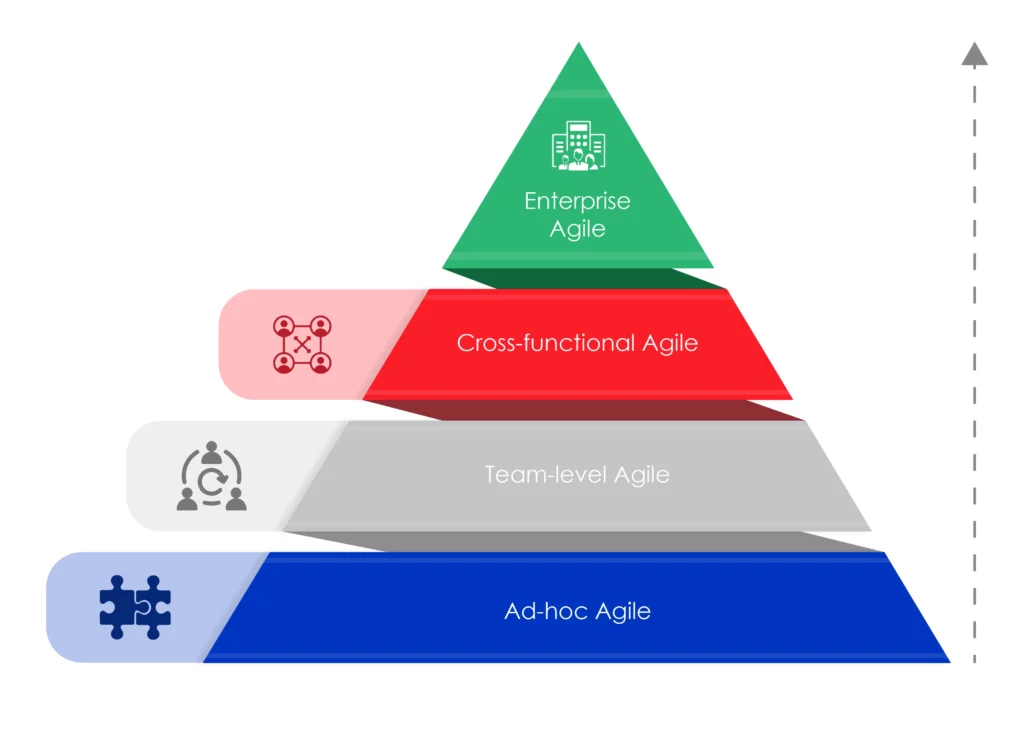

Strategic portfolio management demands a sophisticated approach that integrates flexibility with precision. This guide presents the five key principles required to create a portfolio that not only scales Agile practices but also remains strategically aligned. These principles enhance decision-making and resource optimization, providing the strategic clarity necessary to navigate evolving market demands.

Adopting these principles ensures your portfolio continuously delivers value that aligns with business strategy, adapting to changing priorities without losing focus on key objectives.

Why these five principles matter

With so many frameworks and methodologies available, why emphasize these five principles? They form the essential foundation for scaling Agile, maturing portfolio practices, and ensuring that strategic objectives are met. For leaders guiding transformation efforts, these principles offer a reliable pathway to address the complex challenges of aligning delivery with long-term strategic goals.

Whether your focus is leading an Agile transformation or refining your portfolio’s contribution to business growth, these principles offer a structured framework to overcome the complexities enterprise organizations face today. By embedding them, you can transform your portfolio into a strategic engine that drives measurable outcomes and long-term value.

Principle 1: Integration with enterprise-wide objectives

Principle 1: Integration with enterprise-wide objectives

Even the most flawlessly executed projects can fail to deliver tangible value if they are not aligned with enterprise-level strategic goals. Misalignment creates fragmentation across portfolios, diverting resources into initiatives that do not support long-term objectives.

The challenge: Misaligned portfolios waste critical resources

At the executive level, the primary challenge is ensuring that every portfolio initiative contributes to the organization's strategic direction. Misalignment drains resources, shifts priorities unpredictably, and can lead to a focus on short-term outcomes that offer little strategic value—especially in complex enterprise environments where resources are already stretched across competing initiatives.

Misaligned portfolios typically suffer from three critical issues:

- Resource misallocation: Budgets, time, and talent are misdirected toward projects that fail to support strategic objectives, resulting in inefficiencies and missed opportunities.

- Lack of strategic cohesion: When leaders lose sight of how individual initiatives align with the company’s broader vision, it diminishes the overall impact of the portfolio and leaves high-value opportunities under-resourced.

- Inconsistent decision-making: Without alignment, decision-making becomes reactive and fragmented, with shifting priorities undermining long-term success and reducing portfolio effectiveness.

The solution: Building alignment through dynamic strategic governance

Achieving alignment between portfolio initiatives and enterprise objectives requires more than just upfront planning—it demands ongoing, dynamic governance. This involves integrating strategic oversight throughout the portfolio lifecycle and continuously realigning initiatives with evolving business goals.

Senior leaders should adopt the following approaches to ensure alignment:

- Objective-driven initiative mapping:

Every initiative should be explicitly mapped to key business objectives, with clear metrics to measure its contribution to strategic outcomes. This transparency enables leadership to swiftly course-correct if projects drift off track and ensures that resource allocation remains aligned with priorities that drive long-term value.

- Continuous strategic reviews and adaptive realignment:

Regularly assess each initiative’s alignment with organizational goals through structured strategic reviews. This real-time assessment enables leaders to reallocate resources to high-impact projects as market conditions or business priorities evolve, keeping the portfolio agile and responsive.

- Cross-functional alignment and integrated decision-making:

Create cross-functional collaboration frameworks that promote shared accountability and communication across departments. Breaking down silos ensures that initiatives are coordinated across business units and consistently aligned with the organization’s long-term strategic vision.

Principle 2: Prioritization of value over output

In large enterprises, success is often measured by how efficiently projects are delivered—on time, within scope, and within budget. However, these metrics alone do not answer the most critical question:

What value are we delivering to the business?

Shifting focus from outputs—completing tasks—to outcomes—delivering tangible business value—is critical for achieving long-term strategic success. Without this shift, even well-executed portfolios risk falling short of their potential to drive meaningful impact.

The challenge: Output-focused portfolios create busywork

Many organizations still rely on productivity metrics, such as the number of completed projects or features delivered, to gauge success. While these metrics provide visibility into activity, they fail to capture the true impact on strategic goals. Focusing on output alone creates the risk of "busywork"—where teams remain active, but the results don’t generate meaningful business value.

This challenge manifests in three key areas:

- Deliverables over impact: Teams push initiatives to completion without evaluating whether they advance strategic goals or contribute meaningful outcomes. This shallow focus limits the overall value the portfolio delivers.

- Misallocated resources: Resources may be spent on low-priority tasks that don’t move the needle on business objectives, resulting in inefficient use of time and budget.

- Short-term wins at the cost of long-term success: Organizations may meet immediate productivity targets but fail to position themselves for sustained strategic growth, leaving untapped opportunities for long-term impact.

The solution: Building portfolios that prioritize business outcomes

To avoid falling into the trap of measuring success by output alone, leaders must prioritize initiatives that deliver real, measurable business value. This requires a strategic mindset shift—focusing not on project completion, but on the outcomes that matter most to the organization.

Key approaches to implement value-driven portfolio management include:

- Outcome-driven prioritization:

Leaders should regularly evaluate and rank initiatives based on their potential to deliver measurable business outcomes, such as revenue growth, customer retention, or operational improvements. This ensures resources are concentrated on projects that contribute directly to long-term strategic objectives, rather than short-term productivity goals.

- Strategic metrics for value assessment:

Instead of relying on traditional productivity metrics like project completion rates, leaders should use outcome-based metrics to assess portfolio success. These metrics—focused on business impact, such as market share expansion or cost reduction—offer clearer insight into how well initiatives are contributing to the organization’s broader strategy.

- Continuous evaluation of value contribution:

Value-driven portfolios require ongoing assessment to ensure alignment with strategic objectives. Leaders should establish feedback loops that continuously measure whether initiatives are delivering expected outcomes and reallocate resources as necessary. This approach enables adaptability and ensures that the portfolio consistently drives business value.

Principle 3: Agility in resource capacity planning

Strategic portfolio management success at enterprise-level depends on the ability to dynamically allocate resources with both precision and flexibility. Traditional capacity planning models often lack the agility needed to respond to shifting priorities, but modern organizations must adopt an Agile approach to ensure teams are neither overburdened nor underutilized. This requires real-time visibility into resource availability, coupled with the flexibility to act swiftly on emerging business needs.

The challenge: Static resource models limit responsiveness

Many organizations still rely on static resource allocation models, which plan capacity months or even years in advance. These models lack the adaptability required to respond when business priorities shift or new opportunities arise. The rigidity of static models often leads to bottlenecks in critical areas, while low-priority initiatives continue to consume valuable resources unchecked.

Three common issues that arise from static resource models include:

- Overloaded teams: Rigid planning leaves teams with little ability to adjust workloads as priorities shift, leading to overwork, burnout, and delayed delivery on key initiatives.

- Underutilized resources: When capacity is allocated based on long-term forecasts, key talent can remain idle or misallocated, reducing the portfolio’s ability to adapt to emerging needs.

- Inflexibility in resource allocation: Resources are often locked into fixed plans, making it difficult to pivot quickly in response to urgent demands or high-value opportunities, slowing down time to market for strategic initiatives.

The solution: Building agility into resource capacity management

To achieve true agility in resource planning, organizations need systems that provide continuous visibility into capacity and dynamically adjust allocations based on real-time data. This shift allows organizations to be responsive, allocating the right resources to the right initiatives at the right time, without overextending teams or leaving valuable skills underutilized.

Key strategies for implementing Agile resource capacity management:

- Real-time capacity monitoring and forecasting:

Organizations must transition from static, annual capacity plans to real-time resource forecasting tools. These tools provide immediate insights into resource availability, allowing leadership to identify bottlenecks before they impact delivery. This proactive approach enables continuous adjustment of resource allocations, ensuring that critical initiatives receive the focus they need as business priorities evolve.

- Cross-functional resource flexibility:

By creating cross-functional resource pools, organizations can draw from a broader talent base when priorities shift. This approach breaks down silos, allowing teams to reassign resources across departments as new opportunities arise, ensuring the portfolio remains agile without disrupting ongoing projects.

- Rolling-wave resource planning:

Resource planning should be an iterative process. Rolling-wave planning involves reassessing and adjusting resource allocations at regular intervals, allowing organizations to stay aligned with long-term business goals while remaining agile enough to meet immediate demands. This approach ensures that resource management is responsive and continuously refined as business conditions shift.

Principle 4: Data cohesion for strategic visibility

In strategic portfolio management, visibility is key. Integrated dashboards should offer a unified view that includes resource allocation, financials, risk, and performance. This cohesive visibility empowers leaders to make informed, timely decisions and avoid blind spots that result in reactive, rather than proactive, management.

The challenge: Fragmented data creates decision-making blind spots

For senior leaders, the challenge is not a lack of data, but rather the lack of cohesion across data sources. When insights are scattered across disconnected systems, tools, and teams, decision-makers are left piecing together incomplete information. This fragmentation results in blind spots—critical areas within the portfolio that remain hidden, leading to delays, decision paralysis, or misguided actions that jeopardize strategic goals.

Three key areas where blind spots commonly emerge include:

- Unseen cross-team dependencies: Without a unified view of how teams interrelate, hidden dependencies can emerge as blockers, delaying key initiatives.

- Delayed risk detection and mitigation: Disconnected data makes it difficult for leaders to see emerging risks in real time, preventing timely intervention and leaving the portfolio vulnerable.

- Resource allocation inefficiencies: Without cohesive, real-time data on resource availability, bottlenecks form as some teams become overloaded while others are left underutilized.

The solution: Cohesive data with predictive capabilities

Achieving data cohesion requires more than simply integrating existing tools. Senior leaders must strive for real-time, integrated insights that not only reflect current conditions but also offer predictive capabilities to anticipate future challenges. This forward-looking view enables a shift from reactive to proactive portfolio management, empowering leaders to make decisions with confidence.

Key steps to drive data cohesion and enhance portfolio visibility:

- Unified data integration:

Establishing a single source of truth is critical for eliminating blind spots. This involves integrating disparate data sources across the portfolio—project tracking, resource management, and risk platforms—into one centralized system. A unified dashboard enables leaders to track dependencies, monitor performance, and foresee potential roadblocks, ensuring that key data is available when it’s needed most.

- Scenario-based predictive planning:

Static insights are no longer sufficient for guiding strategic decisions. Leaders must adopt scenario planning models that allow them to simulate various outcomes based on real-time data. These models provide forward-looking insights into the ripple effects of decisions, enabling leaders to anticipate the impact of changes in priority, resource shifts, or potential bottlenecks before they occur. Scenario planning ensures that leaders can see the future consequences of today’s decisions.

- Dynamic risk management through predictive analytics:

Traditional risk logs are reactive by nature, highlighting problems after they occur. To manage risks proactively, organizations should develop dynamic risk heatmaps that update continuously based on new data inputs. By leveraging predictive analytics, these heatmaps can reveal emerging risk patterns across the portfolio, allowing leaders to take action before issues escalate. This proactive approach to risk management ensures that the portfolio remains resilient and adaptable to shifting conditions.

Principle 5: Continuous improvement cycles

In highly mature Agile organizations, success isn’t just about delivering on time or under budget—it’s about embedding a culture of continuous improvement that sustains long-term value creation. By integrating feedback loops into the portfolio management process, organizations can ensure that strategies, processes, and execution evolve in line with growth and shifting market demands.

The challenge: Stagnation in portfolio practices

Without continuous feedback, portfolio practices can stagnate. Early decisions made during planning are rarely revisited, even when they no longer align with evolving strategic priorities. Teams continue executing based on outdated assumptions, and there’s often no mechanism to learn from past outcomes, whether successes or failures.

Stagnation typically manifests in the following ways:

- Rigid, outdated processes: Teams operate within static frameworks, unable to adapt as business objectives or market conditions shift, slowing innovation and responsiveness.

- Failure to integrate lessons learned: Without structured review cycles, valuable insights from completed initiatives are lost, leading to repeated mistakes and missed opportunities for optimization.

- Dependence on legacy tools: Organizations often rely on outdated systems that can’t accommodate the complexity and agility required for modern portfolio management.

The solution: Embedding continuous feedback in portfolio management

To foster a culture of continuous improvement, senior leaders must institutionalize feedback loops at both the strategic and execution levels. This approach drives iterative improvement across the entire portfolio, ensuring long-term adaptability and growth.

Key strategies to integrate continuous improvement cycles:

- Portfolio-level retrospectives for strategic agility:

While team-level retrospectives are common, portfolio-level retrospectives are critical for senior leaders to maintain strategic alignment. Conducting retrospectives quarterly or biannually allows organizations to assess not just individual project outcomes but also the portfolio's overall alignment with strategic goals. These sessions should evaluate resource allocation, risk mitigation, and the success of initiatives against broader business objectives, enabling leaders to adjust the portfolio dynamically based on performance data.

- Real-time feedback loops between business and delivery teams:

Establishing clear feedback mechanisms between business leaders and delivery teams ensures continuous alignment throughout the execution phase. Regular updates and course corrections prevent initiatives from drifting off course. By receiving real-time feedback on progress, leadership can make informed adjustments to strategy while projects are still in flight, ensuring outcomes remain aligned with evolving business needs.

- Applying Kaizen to portfolio management:

Inspired by Lean management, the principle of Kaizen—continuous, incremental improvement—can be applied to portfolio management. Rather than waiting for major shifts, organizations can integrate small, iterative improvements after each initiative. These improvements might involve refining resource allocation processes, enhancing cross-functional collaboration, or improving risk management approaches. Over time, this fosters a culture of learning and evolution, ensuring the portfolio is continuously optimized.

Scaling enterprise agility with strategic alignment

The five principles outlined here provide more than just tactical guidance—they establish a strategic framework for scaling agility across the enterprise while maintaining continuous alignment with business objectives. For senior leaders, adopting these principles transforms portfolio management into a value-centric, adaptive capability that not only responds to shifting priorities but also drives sustainable, long-term growth.

By embedding these principles, your organization can navigate complexity with precision, ensure efficient resource utilization, and maintain the agility needed to adapt in real time. This approach ensures that every initiative actively contributes to the broader strategic vision, turning your portfolio into a powerful engine for future success.

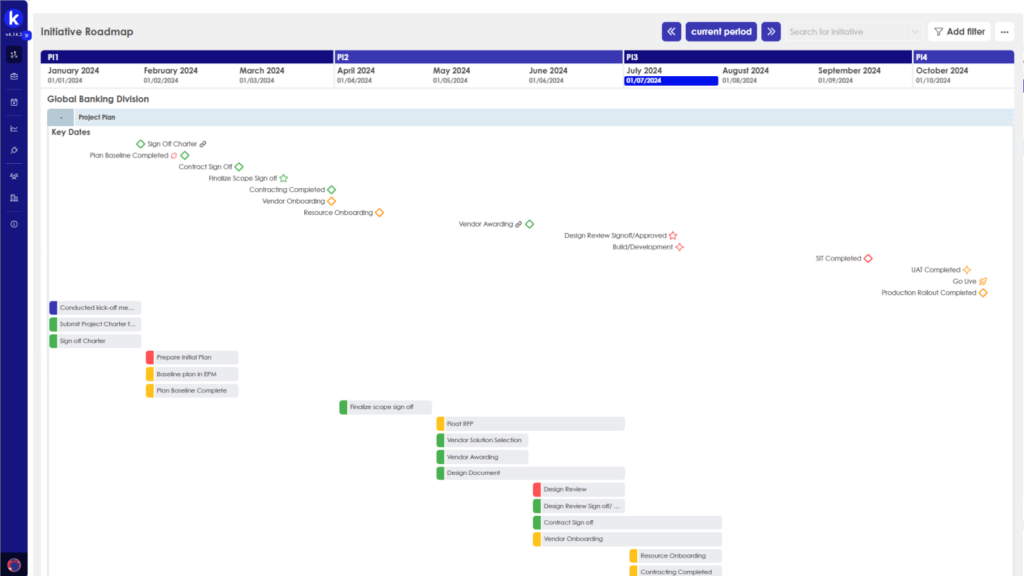

To learn how Kiplot’s Strategic Portfolio Management software can enable your organization to drive measurable value while staying aligned with your most critical business goals, explore our platform today.