Most enterprises want the benefits of agile at scale – but few are set up to fund it properly. Without cross charging, value streams either become unfunded collaborators or fully siloed fiefdoms. You can’t realize value, you can’t share resource without penalty, and you can’t hold teams truly accountable. What starts as a structural shift toward focus and flow quickly turns into duplication, territorialism, and diseconomies of scale. Cross charging is the missing enabler: it allows you to embed focus and accountability without sacrificing flexibility or transparency.

Chargeback vs. Cross Charging

Chargeback is a financial transaction. It often involves real money moving between ledgers, typically across entities with separate profit-and-loss responsibilities—think a Group IT function billing front-office BUs, or a holding company recouping costs from operating subsidiaries. It's commonplace in global organizations, especially where there are tax jurisdictions to consider or regulatory firewalls between entities.

Cross charging, on the other hand, is not necessarily a financial transaction. It is a mechanism for accounting and performance attribution, allowing a business unit to reflect the cost it has incurred in delivering value to another. It may ultimately result in a chargeback, but its purpose is broader: to make costs visible, encourage resource sharing, and create a more accurate reflection of value flow.

💡 Chargeback is how money moves. Cross charging is how value is tracked.

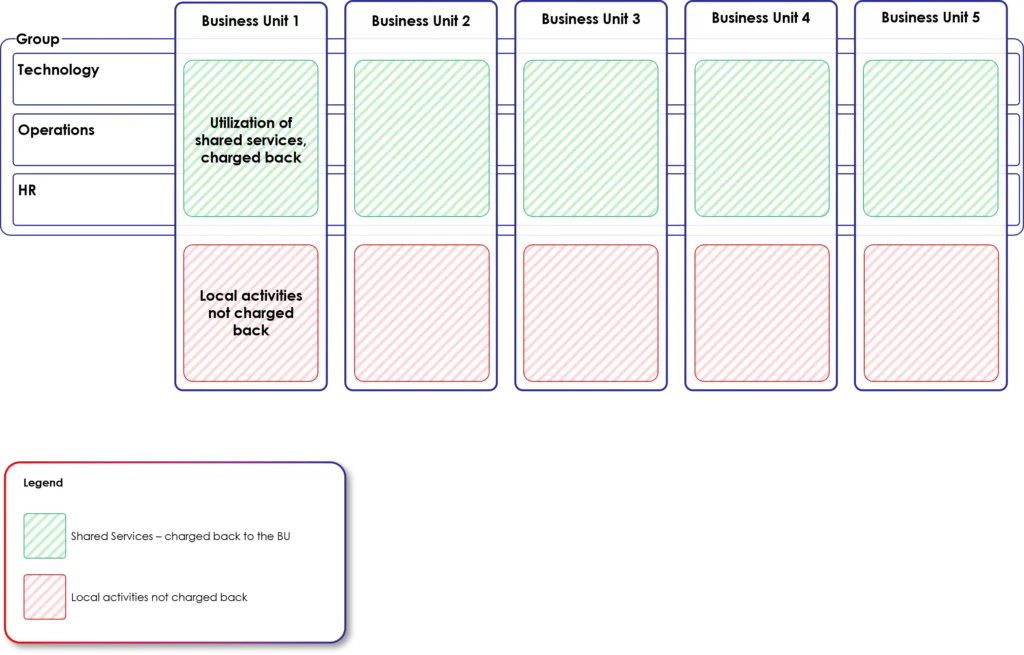

Chargeback illustration:

In traditional enterprise models, central functions like Technology or Operations are delivered by a Group entity and charged back to the business units based on usage. This ensures Group functions are funded — despite not owning revenue directly — and allows costs to be allocated to where they’re consumed.

It’s effective for shared services, but doesn’t solve for cross-BU collaboration — where work flows laterally between business units. That’s where cross charging comes in.

Why it matters

Discouraging Silos

Cross charging also has a cultural function. It allows business units to lend resources without sacrificing budget transparency. The instinct to hoard talent – especially scarce tech talent – is softened if lending a developer to another stream comes with reciprocal financial recognition.

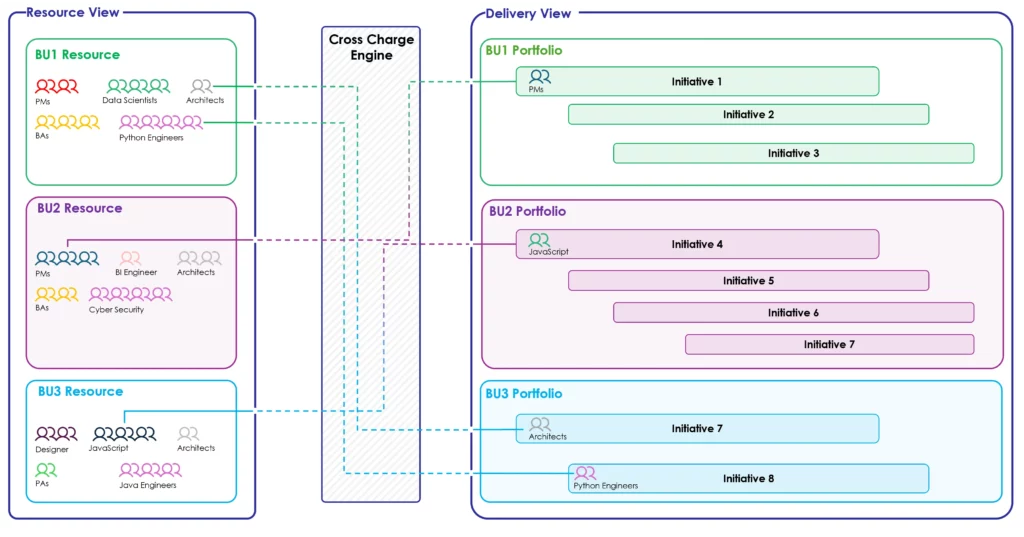

Let’s say the data engineering expertise in your organization sits in Business Unit 1. Business Unit 2 is leading a major transformation and urgently needs that capability. Without cross charging, BU2 has two bad options: either over-hire to build the capability from scratch, or try to “borrow” resource from BU1. But BU1 has no real incentive to share – after all, the cost hits their books, while the benefits land elsewhere. Their P&L suffers, their delivery metrics take a hit, and their leadership team is left explaining why they funded someone else’s success.

Cross charging solves this by making the value flow visible. If Business Unit 1 can allocate the cost of the borrowed data engineers to Business Unit 2, then the transformation sits where it belongs — in BU2’s delivery portfolio and on BU2’s P&L. BU1 retains focus and accountability for its own objectives, while BU2 gets the capability it needs without duplicating effort or destroying trust. Resource moves flexibly, without financial ambiguity or political fallout. Everyone stays in their lane – but lanes are no longer walls.

💡 Everyone stays in their lane – but lanes are no longer walls.

Cross charging illustration:

Value Attribution

Without cross charging, the business unit that funds the work may not be the one that ultimately benefits from it. This makes it difficult to assess the true return on investment for major initiatives—particularly those that span products, channels, or regions.

In the example above, it’s Business Unit 2 that ultimately benefits from the transformation—but if the cost stays on BU1’s books, the value is misattributed. Cross charging ensures the financial accountability follows the benefit, not just the work. And in doing so, it encourages the formation of deep capability centers—like data engineering—that can serve the wider enterprise without being penalized for their usefulness.

Tax Efficiency

In multinational structures, cost needs to follow work. If a UK-based delivery team builds a compliance system for the Singapore entity, allocating all cost to the UK distorts both P&Ls—and may introduce avoidable tax inefficiencies. Cross charging allows the cost to land where the benefit is realized, which matters enormously when transfer pricing rules come into play.

Case Study: How BCG Engineered Collaboration

There’s a well-known (possibly apocryphal) story about how BCG (Boston Consulting Group) tackled the problem of cross-pollination across its global practice. Like most consulting firms, partners were heavily incentivized to sell more work to their own clients—where they had strong relationships and deep contextual knowledge. As a result, collaboration across practices or regions was limited. Despite countless workshops, playbooks, and transformation efforts, behavior didn’t change.

Until someone changed the financial model.

In one region, the CEO ran an experiment: partners would earn 200% of their usual bonus if they introduced another partner to their client and that partner successfully sold work. The result? Partners began falling over themselves to share access. Cross-practice collaboration skyrocketed. Within 18 months, regional revenue had grown by more than 50%.

The moral is simple: you can’t unlock scaled collaboration with structure alone—you have to change the financial fabric that underpins it. Without rethinking incentives, you’re not scaling agile. You’re just redrawing the boundaries of old empires.

Cross charging and scaled agility

Enterprise transformations often promote value stream-based delivery to reduce handoffs, eliminate bottlenecks, and increase focus. But this model—while elegant in theory—introduces structural silos by design.

💡 Poorly implemented value streams are simply silos by a more fashionable name

At small scale, it works. You can build an app. You can manage a domain. But some initiatives inevitably cut across value streams. These are very often the non-negotiable “biggest gig in town” initiatives:

- GDPR and CCPA (California Consumer Privacy Act) didn’t care how you’re structured. They touched every domain—customer data, HR, finance, marketing.

- Solvency II in insurance. IFRS 17. LIBOR decommissioning. ESG reporting mandates. All required coordination across data, systems, and legal boundaries.

- Even internal transformations—like rolling out a new cloud security posture or a shared data platform—cut across every BU.

These aren’t edge cases. In enterprise delivery, cross-value stream initiatives are the norm, not the exception.

And when they happen, you discover you have deliberately built a system that prevents your organization from delivering this kind of initiative.

If every team is funded within its own value stream, who pays for the things that touch them all?

This is where cross charging becomes critical. It gives you the flexibility to build coalitions across streams without forcing unnatural funding workarounds. It allows one value stream to participate in another’s initiative without doing it for free—or not doing it at all.

So what?

Cross charging isn’t an accounting detail—it’s the financial architecture that makes scaled agile real. Learn how to build it in our whitepaper: Agile Project Accounting: The Definitive Blueprint.